I’m a pretty simple guy who likes cheeseburgers, watching a good show on Netflix with my wife and playing with the kids at the lake. So, when I write, I really despise big words that are mostly said in my opinion for the sake of sounding smart. After hearing this particular cringeworthy word for weeks, I’ve hunted the thesaurus, but unfortunately there is no proxy for “disintermediation.”

Disintermediation is defined as the reduction of the use of intermediaries between producers and consumers. Basically, it means to cut out the middleman. This stupid word has been repeated over and over again by CNBC pundits, YouTube stock evaluators, and economic authors over the last few weeks. As AI is becoming a little better understood perhaps, the risks are growing that the emergence of an agentic AI will not only replace employees at firms, but the whole firm itself. Nowhere is this risk more pronounced than in the software industry. Anthropic, private-company maker of the Large Language Model, Claude, recently announced AI plug-ENER 4.61 that has turned software properties, whose ground has looked prone to seismic activity, immediately into the steamy, sulphuric streets of Naples above Italian supervolcano Campi Flegri. Huge software names such as Microsoft, ServiceNow and Salesforce amongst others have just been crushed by the idea that AI can quickly recreate what they do. So, if those companies are trying to charge expensive seat licenses per employee for enterprise CRM software for example, the fear is that an application whipped up on an AI platform can quickly commoditize what they do and be a kill shot to their fat operating margins and crash the company stock.

This fear shows up in the chart of IGV, a software-specific ETF, measured against the S&P 500 Total Return Index over the last 6 months:

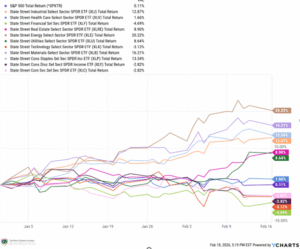

The damage to beloved software stocks has been extensive, but the AI threat is not confined to software. The contagion has spread to the financials, as this week we saw Charles Schwab, for example, down 12% in a single day. The year has started very oddly and it’s a bit like someone flipped the anti-gravity switch. The market is inverted in 2026. What was the third worst in 2025 is now the best. The best in 2025, now the second worst. Financials collectively are the worst performing sector YTD. The second worst YTD? Technology. The market leader YTD despite just $66 oil? It’s Energy, which is doing a keg stand, while Materials and Consumer Staples hold its legs. Everything is upside down as the threat of Anthropic and other AI is levelled at what had been very solid software names.

Value companies such as Lockheed Martin, Chevron & Walmart are at all-time highs. Why? Because they are high asset companies with profit margins that dwell IRL (in real life – even I know that one) and not in the digital space, which can be swept easily away by the rising AI tide. There are some tech names that are down big this year, but while that’s been true the S&P 500 index hasn’t really suffered. Other stocks, such as those value names have risen, as out-of-favor sectors have become more fully valuated in this brief market rotation.

Some rather large companies are starting to catch a bit of a bid in the market with Nvidia reporting earnings next week, so this sector discombobulation may not last long. It’s what we call a “rolling correction” that causes some big damage under the surface, while the index levels at the sealine above show no signs of the roiling below. The reason for it is the weighting of the S&P 500 rests with some very big names that have moved down somewhat, while many others have charged forward resulting in a wash. See the sector performance YTD in the chart below:

Look, AI is a major threat to some companies. Last night I watched and re-watched an interview with Peter Steinberger, creator of OpenClaw2. I realized that in the hands of a computer genius AI can truly elevate sooner than later. He’s figured out how to do Agentic AI with a truly UI (User Interface)-free system that enables you to set up as many bots as you would like to carry out tasks for you. No software or app needed. You just speak what you want into existence into your phone and AI carries out all the tasks for you. You want to tell a bot to scan a restaurant menu to tell you what food to order that you both like AND will hit your macros for the day? No problem and no more MyFitnessPal. Not only that but it will now be easy for AI to pay humans to carry out tasks IRL. I looked at my son who was watching with me (terrible parenting on my part), and when he said “WHAT??”, I didn’t know what to say.

Steinberger, who was able to create the initial prototype of this agentic marvel in one hour via vibe coding, contended that 80% of apps would disappear. What he does NOT mean, I believe, is that technology stocks are all dead. When asked what companies would benefit the most he said that it would be the largest companies that controlled digital ecosystems that would win. He was very convincing. Unfortunately I later found out that while he didn’t sell his OpenClaw software, this genius was just hired by none other than Sam Altman, CEO of OpenAI, an entrant on Santa’s Naughty List this past year. The risks to software and apps just grew.

Fortunately, there is a way to deal with all the AI disruption. We are looking at where the market has been unfairly crushing companies caught up in the selling and are looking to capitalize. There are buying opportunities to be found if you are a sicko like me and have watched countless videos doing Discount Cashflow Analysis of all kinds of tech names over the weekend. (This is what I do for fun. There truly is no help for me). In our Investment Committee today we discussed ways to serve you better, not just thinking about this year and what’s hot, but what we hope will serve you well years into the future. We’re thinking about not just you, but what positions might work best in legacy accounts that you might pass down to your children at a stepped-up cost basis. We’re thinking about what stocks may work best for you over a long retirement. We’ll have more to say on that in the coming weeks. Just know for now that we are sifting through the landslide of tech names for some gems.

It would be very easy to take everything I’ve said up to this point and reach the conclusion that I was bearish on the market. No, I AM a bull. While jobs may be lost, I believe company margins will increase and stock prices will go up as the dollar dives further. This “disintermediation” is scary, no doubt about it. Many companies will go out of business amongst the AI disruption. We’ll try not to swim into any underwater mines. But there will be profits to be had in other companies that ride this big wave. This is but Chapter 26 in the tale of AI & Your Money. Keep reading as some changes are coming in the next chapter. If you listen to us, we’ll change your financial world …

Sincerely,

Scott Wright

Portfolio Manager

The Wealth Training Academy

(Marketing Disclaimer: Past performance is never a guarantee of future results. We offer a lot of services. Our planning, tax, and insurance strategies are designed to improve financial outcomes when implemented as recommended. We’re confident in these strategies, but results will vary based on individual circumstances. Investment results cannot be guaranteed. Unless otherwise indicated, no third party individuals mentioned in this article are clients of our firm, nor have they been compensated for appearing. This article is for educational purposes only – we do not recommend anyone buy or sell any security discussed here. Instead, we recommend readers call our office for personal advice about your circumstances! ~The Compliance Department.)

Sources:

2OpenClaw Creator: Why 80% Of Apps Will Disappear